Bill Gates recently gave Greg Nance of Bainbridge Island $1 million.

Well, it wasn’t to Nance, but it was to the nonprofit he started with four others in 2008 called Moneythink.

The nonprofit was ahead of its time – concerned with college debt it worked to connect high school students to financial aid and the colleges of their choice. It’s motto is “Less Debt, More Degrees.”

Nance said he saw the problem first-hand. He had a choice of going to West Point, where his education would be free, but he would have to serve in the military; or he could pay to go to the University of Chicago, where he ended up majoring in International Relations. He said he had to have a difficult conversation with his dad. “That’s a lot to wrap your head around as an 18-year-old,” Nance said.

Moneythink was co-founded by Nance and four other Chicago students in October 2008: Ted Gonder, Shashin Chokshi, David Chen and Morgan Hartley. Friends from Bainbridge High School also have been involved, including: Diego Medina-Gonzalez, 2006 grad; 2007 grads Nance, Ben Hudgens, Adam Beck and Tess Sadowsky; 2008 grad Caleb Davis; and 2009 grad Madeline Sheldon.

From 2008-16, Moneythink mentored high school students about money and college. One of their first classes was Mike Anderson’s Economics class at BHS in December of 2008. The longtime BHS tennis coach was “a wonderful mentor to me and generations of Spartans,” who died in a drowning accident in 2014.

College volunteers would go to high schools to show students about finances they “did not learn in school,” Nance said. “That was all well and good, but we wanted to reach more students. It was a nationwide crisis.”

He said students came from all types of situations – they had to take care of their mom or aging grandparents, for example. “There are tons of personalized information,” he said.

So, from 2016-19 Moneythink focused on virtual coaching where students could be reached “where they’re at.” Nance said federal financial aid is complex, but it’s even harder for those who are undocumented.

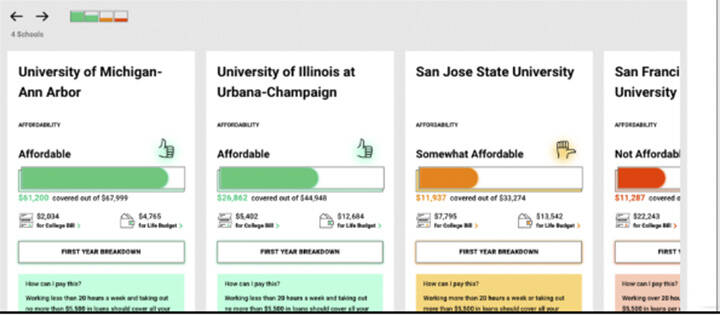

And since then it has focused on DecidED, a free app that can help students find out the same information on their own using the internet. “It tells the true cost of college,” Nance said, adding financial aid letters are confusing because, “They want you to sign on the dotted line and not think much about it.

“It’s a massive, stressful decision people have to make,” he continued. “This massive debt limits our freedom. It affects every segment of society.”

By using their free app, Nance said, “The American Dream is revitalized.”

The reason the app can be free is because of donations like their largest ever – $980,000 from the Gates Foundation.

“With this tremendous boost, we are thrilled to enable Moneythink’s ability to develop and deploy its DecidED tool into its next phases of evolution,” said Nance, board chair. “Since our founding, we have strived to create meaningful change and impact across the country. This opportunity brings us an important step closer, fueling our tech-enabled tools for individual students and college advisors while aggregating critical data to inform system-wide decisions that put students in the driver’s seat.”

CEO Joshua Lachs added: “This catalytic support from The Bill & Melinda Gates Foundation is a further show of confidence that Moneythink is uniquely positioned to set historically underserved students up for academic and career success by eliminating the surprise financial stressors plaguing millions of young people. With our distinctive solution, we are able to offer life-changing resources — and real hope — for current and future generations of students.”

Nance was working in China and home visiting in 2019 when COVID hit so he’s been working from home ever since. He said he’s actually a volunteer with Moneythink. His paying job is recruiting techs and being sponsored as an ultra-marathon runner.

About Moneythink

Moneythink’s website says its goal is to inspire younger generations to make informed immediate and long-term financial decisions and build financial wellness habits through empathy, mentorship, education, coaching, and practical and emotional support.

It continues saying: Moneythink has served over 33,000 students across the country. As of 2018, our students accessed over $2.4 million in financial aid. With years-long generous philanthropic support and strategic partnerships, our organization is now a flourishing 501c3 nonprofit with our national team based in the San Francisco Bay Area.

To grow our impact, Moneythink designed and released DecidED a free web-based tool that helps students compare the affordability of college offers against other criteria, such as graduation rates. Moneythink creates accessible college affordability solutions to help students who have been traditionally left at the margins. DecidED enables students to accurately determine which schools offer the best value and create responsible plans to pay, setting them up for college and life success.

The nation’s $1.7 trillion in student debt is fueled by lack of transparent college costs and a confusing financial aid process, Moneythink says, adding other challenges are:

•Getting a college degree is one of the biggest factors in breaking the cycle of generational poverty, yet college degrees are unaffordable for many.

- There are limited affordable options, which leads to low graduation rates and high student debt.

- The average amount of assistance a high school student receives from college counselors is only 38 minutes across four years.

- Only 11% of low-income students attain a college degree, compared to 58% of high-income students.

- Due to the lack of clear financial information and lower cost options, students are forced to take out exorbitant college loans.

- Nearly 60% of the outstanding student debt is held by Pell recipients. 19 million borrowers, or 31%, did not complete their degree.

Moneythink has received national recognition, such as Capital One’s 2020 Give Back Nonprofit of the Year Award, Goldman Sachs’ Impact Challenge Fan Favorite Award, White House Champion of Change Award under President Obama, and many others.