Here’s a story that is growing bigger by the day: Cyber scams are on the rise.

My elderly family member fell for a common scam a few weeks ago: His screen appeared to be locked by “Microsoft,” and he was urged to call the number the phony security alert displayed. If you call that fake number, a fake Microsoft representative will ask you to provide access to your computer, so he can steal sensitive data or download malicious apps.

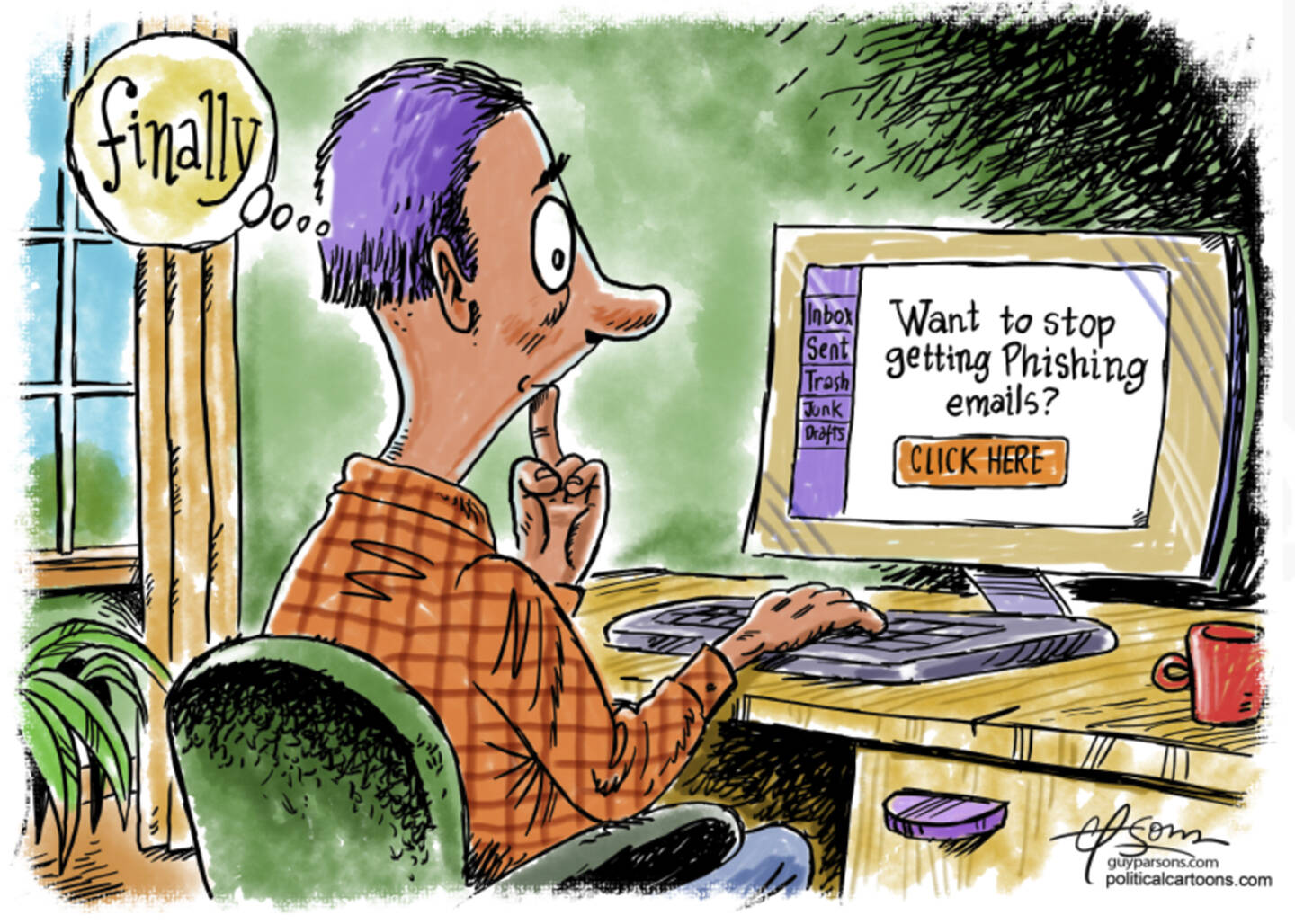

To be sure, in the digital era in which we all now live 24/7, you must assume that every email, text and phone call might be a scam! Google “ransomware attack” and you’ll see a sizable list of big companies and entire cities that have been completely shut down by scammers. Scammers also spoof text messages. Apparently from reputable companies, such as banks, the messages trick people into revealing passwords or credit card numbers.

Scammers continue to succeed with the good old landline telephone, too. I received a call this year from a man claiming he was from the Social Security Administration, who told me my account was blocked, and he would help me reactivate it. Aware that Social Security never makes phone calls (unless you’re having a legitimate conversation with it), I knew what the scammer was after: my full name, birthdate, address and Social Security number.

I asked him how he could sleep at night, knowing he was hurting innocent people. He cussed at me and hung up. The greatest worry about scammers is that elderly people are especially at risk. They’re more trusting of callers from government agencies and more likely to fall for one especially mendacious tax scam.

Using phishing techniques, scammers access data on a taxpayer’s computer, then use that stolen information to file a fraudulent tax return in the taxpayer’s name and have the refund — often larger than is actually owed — deposited into the taxpayer’s actual bank account. According to Intuit, the scammers then “contact their victims, telling them the money was mistakenly deposited into their accounts and asking them to return it.” Many victims, fearful of the IRS, readily comply.

According to Pew Research, Americans view cybercrime as their greatest security concern. But what are government agencies doing to combat it? Not enough.

Americans are often victimized by scammers operating from elsewhere in the world. How can the bad guys be tracked down and forced to make amends? Nation-states are often behind sophisticated attacks on organizations. Russian-financed scammers are actively targeting our utilities, election systems and other systems.

Creating new laws and agencies to combat cybercrime is a daunting challenge. Cybersecurity bills passed by the U.S. House move slowly through the Senate. Even if the Senate passes them and the president signs them, regulators could take months to draft and implement actual policies. Scammers aren’t bogged down by such bureaucratic red tape.

What it comes down to is that every person must learn to detect and avoid cyber scams. The Department of Homeland Security has helpful info at www.dhs.gov/stopthinkconnect-cyber-tips. Always verify that an email, text or link is legitimate before you click. Always be suspicious — because scammers are getting more sophisticated by the day.

Copyright 2024 Tom Purcell, distributed exclusively by Cagle Cartoons newspaper syndicate. See Purcell’s syndicated column, humor books and funny videos featuring his dog, Thurber, at TomPurcell.com. Email him at Tom@TomPurcell.com.